A Smarter Way to Finance Your Home

Discover the patented Hybrid Note with 0% Rate features — available only through 0 Rate Mortgage.

Homeownership shouldn’t mean being trapped in high-interest payments. Our innovative Hybrid Note makes your mortgage more affordable and helps you build equity faster.

Get a Free Consultation Today

How It Works

How the Hybrid Note Works

Our patented Hybrid Note combines the stability of a traditional mortgage with a revolutionary 0% Rate feature. The process is simple:

Bank Mortgage Creation

The bank offers a belowmarket 0% mortgage rate for property purchase or refinance by the borrower.

Secondary Market Purchase

The mortgage note is assigned to a secondary market buyer at more than 30% of the mortgage's face value.

Government Note Purchase

A negotiable government or NGO Note is purchased using the current bond price percentage.

Securitization

The mortgage note and government Note are combined into a single negotiable hybrid Note.

Why Choose Us

Experience You Can Trust

With decades of combined expertise and the only patented mortgage innovation of its kind, 0 Rate Mortgage delivers unmatched value, security, and support.

Licensed Experts

Patented Innovation

Personalized Support

Professional Team

Key Benefits

Why Choose the Hybrid Note?

Traditional mortgages keep homeowners locked

into high interest. With the Hybrid Note, you enjoy:

Predictable Payment Structure

Know exactly when your mortgage will be paid off with no variable interest changes.

Potential Long-term Savings

Avoid decades of compounding interest payments typical in conventional mortgages.

Lower Monthly Payments

Principal-only payments result in significantly reduced monthly obligations.

The zero percent interest rate mortgage provides borrowers with a transparent alternative to conventional financing models. By consolidating the lender's profit into a Pooled Subsidy fee, borrowers gain clarity on the true cost of their mortgage and benefit from substantially lower monthly payments throughout the loan term.

See Your Potential Savings

Use our Hybrid Note calculator to discover how much you can save compared to a traditional mortgage. Every dollar saved is another step toward financial freedom.

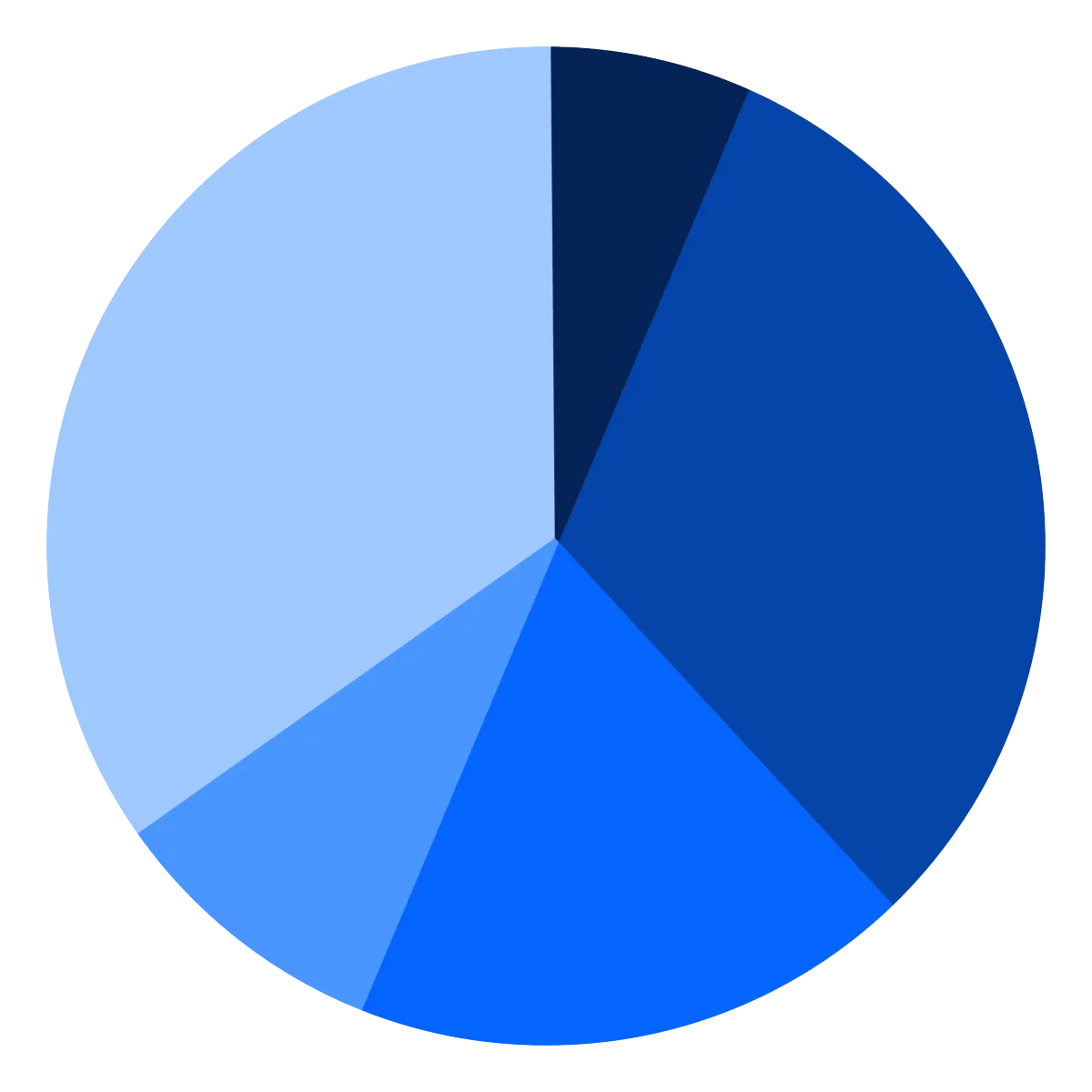

For a $300,000 home purchase

The buyer makes a 10% down payment ($30,000)

The $270,000 mortgage note is purchased

By the secondary market buyer for $180,900 (67% of face value)

The buyer invests $89,100 in zero coupon Treasury Bonds.

Creating a hybrid Note

With a face value of $510,810.81

Down Payment

Mortgage Note Purchase

Treasury Bond Purchase

Mortgage Insurance

Investment Reserve

See Your Potential Savings

Use our Hybrid Note calculator to discover how much you can save compared to a traditional mortgage. Every dollar saved is another step toward financial freedom.

For a $300,000 home purchase

The buyer makes a 10% down payment ($30,000)

The $270,000 mortgage note is purchased

By the secondary market buyer for $180,900 (67% of face value)

The buyer invests $89,100 in zero coupon Treasury Bonds.

Creating a hybrid Note

With a face value of $510,810.81

Learn More About the Hybrid Note

Want to dive deeper? Download our patented Hybrid Note explainer and visit our resource center for educational guides and FAQs.

Testimonials

Real Homeowners.

Real Results.

Thousands of families have already discovered the peace of mind that comes with 0% interest mortgage payments. See what real homeowners are saying about their experience with the Hybrid Note.

Become a Partner Broker

At 0 Rate Mortgage, we believe in building strong partnerships. Through our collaboration with Elite Financial Strategies (EFS), brokers and agents can join a proven system designed to maximize client value and provide long-term commissions.

Access to Elite Mortgage Processing

Personalized affiliate link

Commission payouts bi-monthly

Transparent reporting